How Big is the California Deal?

Measuring the true scale and impact of the latest California-Google agreement

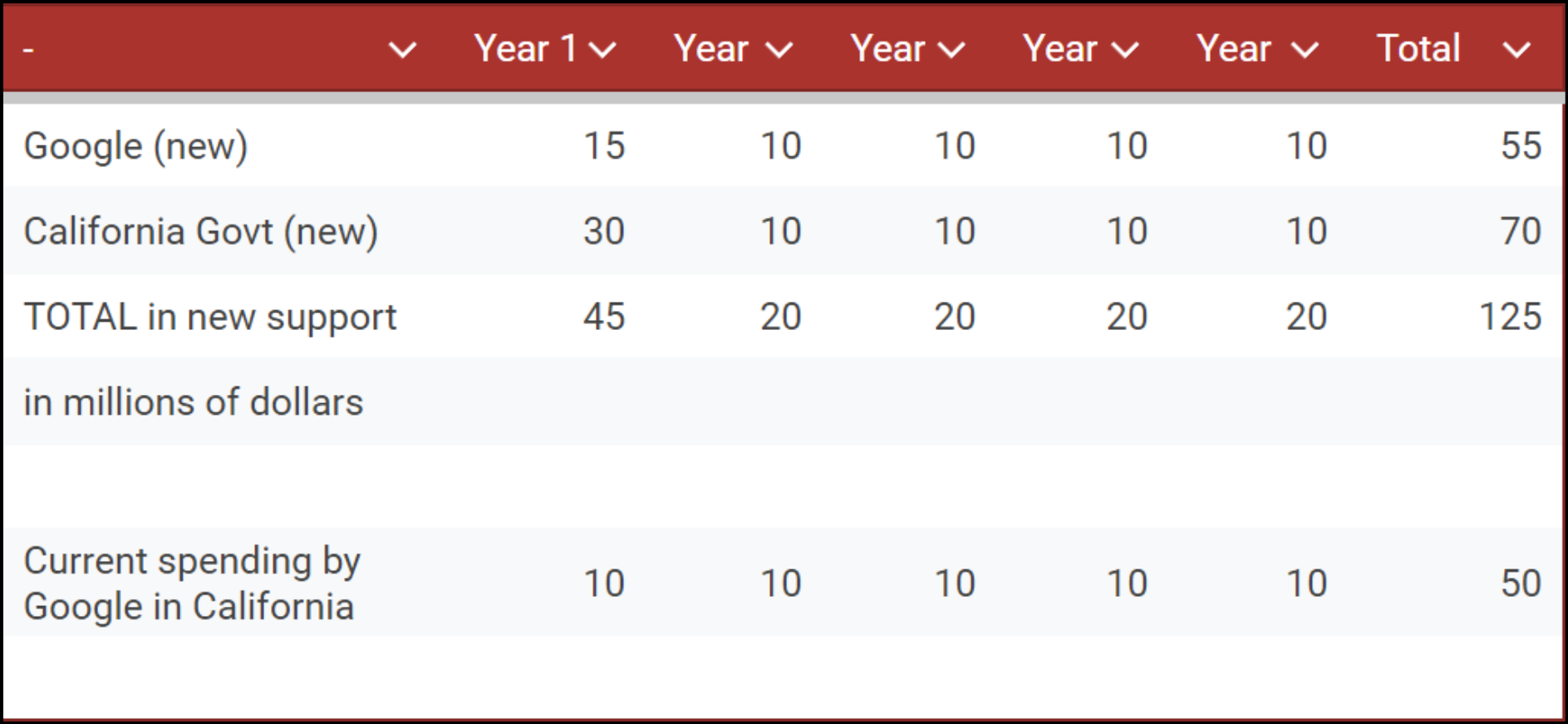

The new deal would provide…

-

- $45 million in new money in the first year ($15 million from Google and $30 million from the state) and at least $20 million per year in out years ($10 million from Google; at least $10 million from the state). This goes to a fund that would distribute support based on the number of editorial employees in California newsrooms. This could go up or down in out years.

- Additional funds for a National AI Accelerator. As of now, it is unclear the total amount or who is contributing to that.

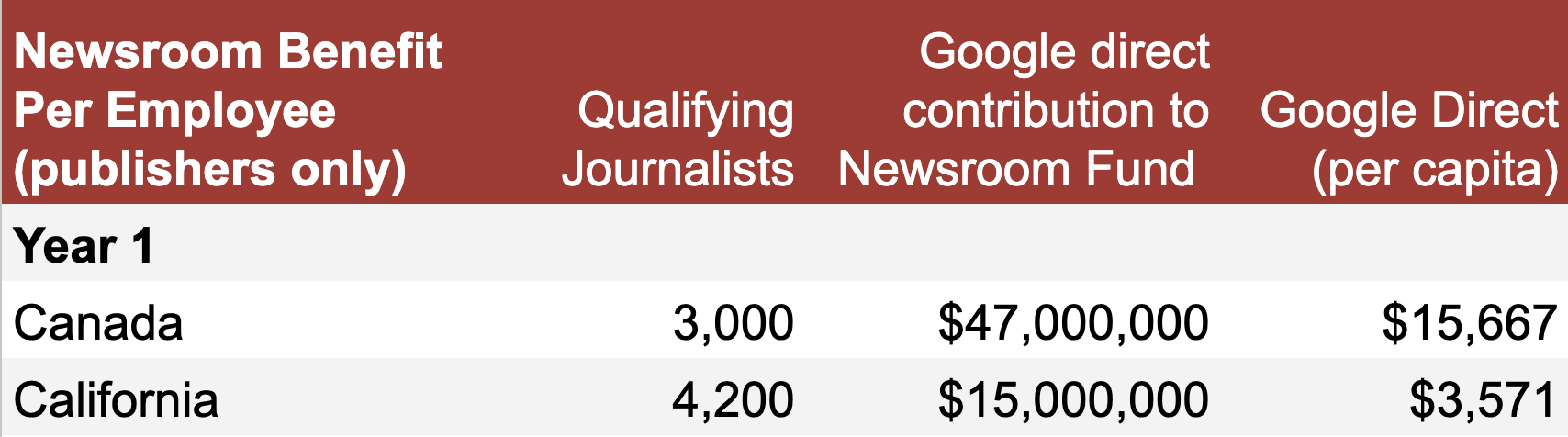

- Rebuild Local News estimates that this would provide newsrooms with a subsidy of roughly $7,000-$10,000 per eligible editorial employee in the first year.

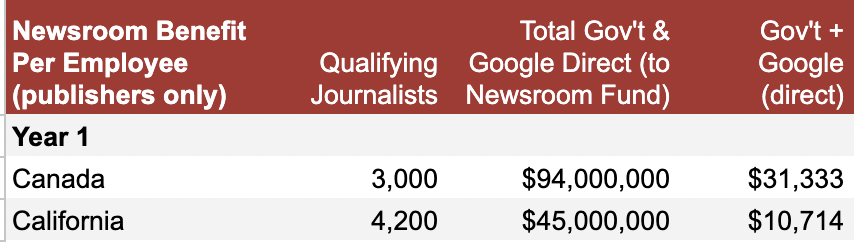

The official breakdown has not been released, but based on what we had heard earlier, it appears the local news jobs portion will look something like this:

Of course groups in California (including the Rebuild Local News coalition members) will be pushing for that government commitment to remain at $30 million. If that happened, the 5 year total could be more significant.

How the deal compares to other jobs-based programs to help local news…

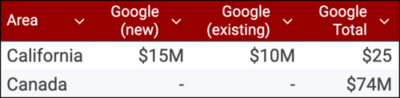

Google has argued that a true apples-to-apples comparison would include in both cases how much they spend currently for the Google News Initiative and Showcase. This chart does that. The $47 million from the government includes a separate program that provides a “labor subsidy” for newsrooms tied to the number of journalists they have.

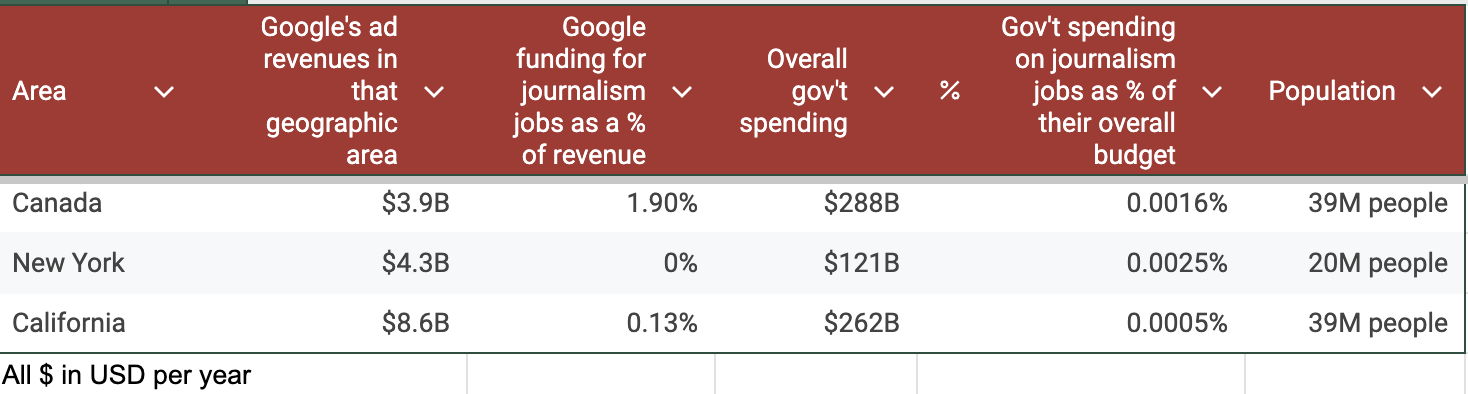

Here’s how the California deal fares if you take into consideration the size of Google and the governments

Canada: The $74M Google figure includes both publishers and broadcasters, while the California agreement, at this point, excludes broadcasters. The publisher-only component of the Google figure is $47M. Also, Google says that when they did that deal they cancelled other spending so the apples-to-apples comparison should show $11 million plus $10 million for GNI, or $21 million rather than $11. Combined with what the Canadian government contributes to its separate Labour tax credit, that would be $94M total for publishers (excluding broadcasters).

New York: The government will provide up to $25,000 per qualifying editorial position/year (i.e. 50% of salaries up to $50,000). The actual average subsidy per job may be lower than $25,000 because there are caps on the overall dollars a newsroom can receive. This is an average over three years.

California: These are annual averages based on the 5-year committed funds from the agreement. At this point, the government is committing $70 million over five years to the jobs fund; Google is committing $55 million over five years. Google separately has committed to an additional $50 million during that time in California Google News Initiative and Showcase investments. If these are included, it would bring Google’s annual average to $21 million per year.

SB1327: Paid for by a fee levied on Google, Meta, Amazon and other high-revenue advertising firms that extract value from consumer data.

Per Employee

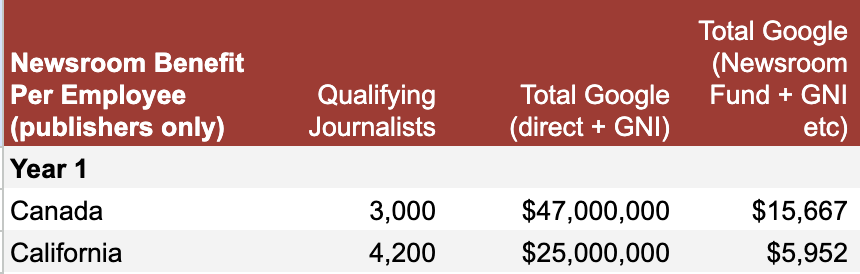

Another way to compare is to look at the payments per employee. By this standard, California deal is lower than Canada – both when you look only at Googles contribution, and also when you look at Google and the government.

The complicating factor is that Canada’s deal included broadcasters, while the California deal does not. To create an apples-to-apples comparison we have taken the Canada spending just for editorial employees in “publishing” (i.e. non broadcasting). The employee numbers come from News Media Canada, a trade association representing media companies.

The employee numbers for California come from Rebuild Local News’ own detailed analysis. This chart is for “publishers” only, not including broadcasters or freelance.

This chart provides the per employee numbers if you include both Google’s direct spending to the fund and the government’s spending.

Google makes the argument that the true apples-to-apples would be to include their contributions to the Google News Initiative and the Google Showcase. It’s hard to know whether those are apples or pears since those payments go to newsrooms in general, not on the basis of headcount. If we add that in there, the numbers do improve for Google. But the California deal is still much less.

Compared to Revenue

It’s also useful to see how the spending by Google compares to the revenue it earns in California and in Canada. Here are some key stats following by some deeper number crunching.

- 2023 California ad revenues for Google, Meta, Amazon: $20 billion

- Profit margins of large advertising platform businesses: 40-50%

- Percent of 2023 California Google, Meta, and Amazon ad revenues that would be needed to achieve a target of $125M/year: 0.625%

Compared to Need

The decline of local news in the United States and California has been severe…

-

- Decline in amount of newspaper revenue in US since 2005: 82%

- Dollar amount of loss of newspaper revenue in US: $40 billion

- Decline in the number of reporters in California since 2002, according to the Medill School of Journalism: 68%

- Amount of money it would take to replace that loss in California between earned newsroom revenue, philanthropy, government, and tech sector: $375 million

- Amount of money needed per year from just government and tech sector in California: $125 million