Community News Investment Fund

A New Approach to Financing Local News Sustainability and Growth

Editorial Note: This is a draft for a paper we’ve been circulating for a new approach to financing local news. We’re still iterating so let us know what you think

One of the least discussed aspects of the local news crisis is the lack of adequate financing to help build sustainable business models.

Most major financial players have a particular model: consolidate as many news organizations as possible, and cut costs dramatically (including by eliminating reporting positions). In the worst cases, this has left “ghost newspapers,” which continue to earn some revenue from remaining subscribers but do little to cover their communities.

Meanwhile, banks usually avoid lending to smaller local media, especially startups and those in under-served communities because they are viewed (with some justification) as risky businesses.

Foundations have entered the fray but mostly through grants to nonprofit organizations. But few of them have invested in the kinds of creative financing work that philanthropy has experimented with in other sectors, such as low income housing or green energy. The grantmaking is extraordinarily valuable but there is not enough philanthropic support through pure grantmaking to cover the full needs of local news organizations.

We need a new collection of financing “products” that lay in between high-ROI financing and traditional grant giving. This would provide a source of ready capital – in servings small and large – to a variety of players that are trying to help create, transform or sustain an entity committed to local reporting. Just as important, it would enable limited philanthropic dollars to go much farther.

To be clear, we’re not suggesting that with smarter money managers, we’ll be able to find news organizations that will be wildly profitable. Rather, we need a new approach focusing on the crucial twin goals of being sustainable and meeting the information needs of the community.

This is a missing piece of infrastructure that could ultimately help thousands of local news players to thrive. Done well, a local news financing fund would make precious philanthropic dollars go at least 2x-3x as far as traditional support, and perhaps much more.

Limitations on the Current System

The shortage of local news financing options has led to a number of problems.

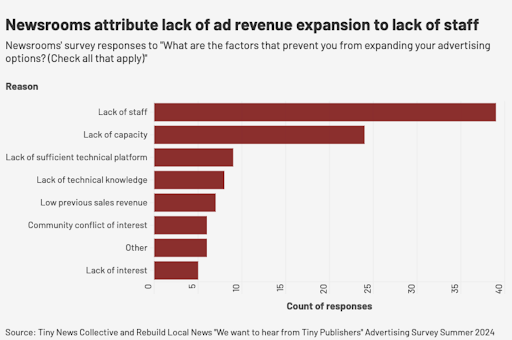

Inability to invest in revenue-producing hires. Every nonprofit knows that hiring a full-time development leader would be a game changer, helping it become sustainable in the long run. But it often takes 1-2 years before they pay for their salary and then start producing significant revenues for the organization. Few organizations have the runway capital to do that. Similarly, many commercial news organizations could increase their revenue by adding an ad sales professional, reader revenue staffer or product designer but they don’t have the runway to hire that person and wait for the financial impact to kick in. A recent study by Tiny News Collective and Rebuild Local found that lack of revenue-focused staff was a bigger impediment to revenue growth than technological gaps.

The American Journalism Project has made great strides in this area but they are currently touching 50 nonprofits. There are 6,000 newspapers and 300 local nonprofits. We need a solution that can provide financial support efficiently for a larger number.

Small outlets often have severe cash flow shortages. Many small media companies – like many small businesses in general – have cash flow problems that result from the timing (rather than the amount) of receivables. An example that was provided to us: a small news site is getting a government check but it won’t come for 8 months and they’re unable to hire the staff in the meantime to start implementing the grant. This is especially true for smaller outlets in low and moderate income communities, and, given historical redlining practices, may be especially a problem in communities of color.

It is hard for local communities to put together capital to acquire a legacy newspaper. Some of the 6,000 legacy newspapers could be acquired by community organizations or local owners from chains that no longer view them as worthwhile in the context of a publicly-traded company or ownership by a financial firm. But to execute such a “replanting” transaction – which in some cases must happen rapidly – they need capital for acquisition, legal bills, financial planning and more. In some cases, they would be bidding against a hedge fund or private equity firm. And then in some cases, additional financing is needed to help transition the new publication into a viable position. Some of the same issues make it quite difficult for owners of community papers that are nearing retirement to transition their publication to new owners that are based in the community. To some degree, the National Trust for Local News is attempting to provide expertise and sometimes capital for such deals. But ultimately they either need to have a much bigger pool of lending capital or there needs to be a separate institution that provides this service for them and others that are not working through NTLN.

Inability to make essential technical upgrades or product development. Many local newsrooms have conceived of tools that would better engage readers or advertisers but there are upfront costs – coding, data collection and cleaning etc. Many of these could pay for themselves and then produce profit that could be plowed back into the operation over time but the organizations do not pull the trigger because they lack cash.

Limits on the ability of local news organizations to merge. In some cases, consolidation may well be the right move for the community or both parties. But there are often obstacles – ownership stakes, salary or pension commitments, legal costs. Those present prohibitive short-term challenges but could unlock significant value for the community.

In terms of the goals of Press Forward, this could powerfully help with “people,” “operations” and, especially, “revenue.”

The “Products”

There are now some experiments under way that can help teach us the best approaches. Rebuild Local has been working with URL Media to create a pilot program run by the National Community Reinvestment Coalition. It will provide small loans to URL Media members to cover cash flow issues, starting with a $300,000 pool, and providing loans of $50,000-$75,000. URL Media will help source and vet the best potential customers. In addition, American Journalism Project has gained valuable experience subsidizing the hiring of revenue-producing local news staff, and the National Trust for Local News has experimented with different financial arrangements to acquire and run local papers to keep them from being sold to hedge funds.

It seems that there are three types of financial products to be considered. In all cases, the Community News Fund would use a rigorous set of criteria to determine the worthiness of potential beneficiaries. More study is needed on which financing tools would be most suited to the aforementioned needs. Potential tools might include:

Loans – The Fund would expect the capital to be repaid, but on a longer time horizon and lower interest rates (sometimes referred to as “concessional financing.”)

Loan-to-grant programs – Under this scenario, the funds would start out as loans but could be converted to grants under certain circumstances. It could be, for instance, that it’s turned into a grant if they reach certain goals of improved community coverage. It could be like the Payroll Protection Program, which turned loans to grants if small businesses maintained their staffing levels. Or it could be that some are forgiven because they didn’t succeed at creating sustainable revenue but tried hard and achieved other worthy goals.

Loan guarantees, reinsurance or collateral – The Fund could guarantee a loan provided by some other entity, perhaps the Program Related Investment portion of a foundation. This could create incentives for foundations to experiment more with their PRI funds in this realm. Or the Fund might arrange for guarantees from other entities, such as a Community Development Finance Institution, or perhaps the inverse, providing a guarantee that would allow greater lending from a CDFI.

Who and What Might Be Eligible

Here are some examples of the types of projects and beneficiaries that might be considered:

-

- A nonprofit news outlet wants to hire a full-time development officer or advertising seller but knows it will take 18 months to bear fruit

- A newspaper wants to hire a new advertising seller or development officer but doesn’t have enough capital

- A nonprofit newsroom is trying to buy and convert a local newspaper

- A small news outlet has an advertising deal that will provide money 6-12 months out but doesn’t have enough up-front cash to support the marketing or journalism to fulfill the deal in the meantime

- A Black newspaper wants to better transition to digital subscriptions

- A local newspaper in Illinois or New York knows its going to get a tax subsidy 12 months later but needs to borrow against that for current costs

- A local business leader hopes to acquire or start a community-grounded publication

- A public radio station wants to merge with a local paper

- A newspaper wants to open a coffee shop (or other community service) to engage residents and provide revenue but lacks startup capital

- A nonprofit wants to develop an earned revenue stream outside of philanthropy – advertising and events – but needs someone with expertise to do it

- A Community Development Finance Institution would support local news if it had a guarantor on some of its investments

- A newspaper could become eligible for government advertising if they modernize their ability to accept multiple ad units on their website

This should probably be focused on entities that are likely to remain committed to their communities:

-

- 501c3 organizations with the stated mission of serving the news and information needs of a particular community or multiple communities.

- Small for-profit entities that are community-grounded and unable to get capital for sustainability and expansion opportunities.

- Public Benefit Corporations that have as their declared public interest purpose the long term serving of a community’s news and information needs. These would need to be accompanied by stipulations preventing the sale of the organization to a national for-profit chain except under certain restrictive conditions.

The Structure and Government Role

More research is needed on the best structure. Most likely this should start out as an independently-funded entity, and then in a second phase, seek potential government support or back-stopping:

Phase 1 – A 501c3 financed largely with philanthropic grants but also potentially some funding from Program Related Investments. The Media Development Investment Fund in Europe has been profoundly important in sustaining independent journalism in Eastern Europe. Backed mostly by foundations and social impact investment firms, it has provided $316 million in financing to 152 media outlets in 57 countries struggling to build a free press. In some cases, the loans are repaid, in others the principal is recovered and 9.5 percent of the investment is written off.

Phase 2 – A government loan guarantee program backs up financing. The government does this frequently – including guarantees to mortgage providers to make it more likely that a wider range of people can afford home ownership. The VA does it for veterans; the Federal Housing Agency does it for people with limited credit history. Because the risk is reduced, lenders become willing to lend extensively. The Small Business Administration, the Economic Development Administration and other agencies provide government backing for stimulates giving to a variety of purposes, from sustaining family farms to recovering from disasters. Another related model is a Government Sponsored Enterprise (such as Fannie Mae and Freddie Mac) which not only guarantee loans but also buy up loans in the secondary market and issue bonds to raise capital.

These approaches would allow philanthropic funds to have a dramatically bigger impact. For instance, assume philanthropic organizations would normally offer $100 million in grants per year over ten years, or $1 billion in total. If we assume instead that, say, half of that is distributed in the form of loans that get repaid during the period, that would mean the initial investment would have leveraged an additional $500 million. It may end up being more since each repaid loan could be recirculated back out in the form of new loans.